Understanding Needs and Wants

Understanding the difference between needs and wants is one of the cornerstones of economics. These two terms drive much of how societies function and economies work. Let’s dive into these concepts and see how they play out in our daily lives.

What are Needs?

Needs are essentials; they are things we absolutely cannot live without. Picture yourself stranded on a deserted island – what would you wish for? Perhaps water, food, clothing, and shelter? These are perfect examples of needs. They are crucial for our survival. Without food and water, we wouldn’t have the energy to function. Without clothing and shelter, we wouldn’t be able to protect ourselves from the elements.

Imagine if you didn’t have a roof over your head during a snowstorm, or you had no food for days on end. It’s a scary thought, isn’t it? That’s why we classify these things as ‘needs’.

What are Wants?

Now, while you’re stranded on this imaginary island, you might also wish for a comfortable bed, a fancy meal, or maybe even your smartphone to scroll through social media. While these things might make life more comfortable or enjoyable, you don’t necessarily need them to survive. These are ‘wants’.

Wants are often shaped by our surroundings, societal pressures, or personal desires. For instance, do you remember the latest video game you saved up for? Or that trendy pair of shoes you couldn’t wait to buy? These are all wants. Life could go on without them, but having them brings joy, comfort, or status.

How Needs and Wants Change Over Time

One interesting thing about needs and wants is how they change over time. Let’s take technology as an example. A few decades ago, owning a computer was considered a luxury, something people wanted but didn’t need. Fast forward to the present, and computers are almost as essential as electricity and running water, especially in certain parts of the world or professions.

Similarly, our personal needs and wants can change as we move through different stages of life. A teenager might want the latest fashion trends, while an adult might need a reliable car for their daily commute.

Why Understanding Needs and Wants is Important

Understanding the difference between needs and wants helps us make informed decisions about how we use our resources. It’s also fundamental to understanding how economies work. From a personal finance perspective, if we spent all our money on our wants (like buying every new version of a smartphone), we might not have enough left for our needs (like paying for groceries or rent).

At a larger scale, governments and businesses have to make similar decisions. Governments need to decide how to allocate resources for things like healthcare (a need) and recreation facilities like parks or museums (a want). Businesses, on the other hand, need to figure out what products or services to offer – are they addressing a need or a want? How does that affect the demand for their product?

To wrap up, distinguishing between needs and wants isn’t just an academic exercise – it’s something we all do, consciously or subconsciously, in our everyday lives. Understanding these concepts can help us make better decisions, whether we’re shopping for groceries or running a country!

The Central Purpose of Economic Activity

Economics is all around us; it’s woven into the fabric of our daily lives. From the moment we wake up to the time we go to sleep, we are participating in economic activity. But what exactly is the central purpose of this ceaseless activity? Let’s take a closer look.

Economic Activity: A Quick Introduction

Before we delve into the heart of the matter, let’s clarify what economic activity is. Economic activity involves the production, distribution, and consumption of goods and services. Whenever you buy a book, a baker bakes a loaf of bread, or a company ships products across the globe – economic activity is taking place.

What is the Central Purpose?

So what’s the central purpose of all this hustle and bustle? Simply put, the primary goal of economic activity is to produce goods and services to satisfy needs and wants.

Imagine a day in your life. You wake up in a warm bed (a product), brush your teeth with toothpaste (another product), and eat breakfast (more products). Perhaps you then hop on a bus (a service) to go to work, where you use a computer (another product) and internet services. Each of these products and services exists because of economic activity. Their production and delivery are aimed at satisfying your needs and wants, and this is the essence of economic activity.

Why is this Purpose Important?

Fulfilling needs and wants is vital for both individuals and society as a whole. On a personal level, goods and services enhance our quality of life, allowing us to enjoy comforts and conveniences.

On a societal level, the production of goods and services provides employment, contributing to income and overall economic health. Think of all the jobs involved in bringing a simple product like a pencil to your doorstep: loggers to harvest wood, miners to extract graphite, factory workers to assemble the pencil, marketers to advertise it, and truck drivers to deliver it. Each of these jobs is a cog in the wheel of economic activity.

Moreover, governments rely on economic activity to raise revenues through taxes, which are then used to provide public goods and services, like roads, schools, and hospitals. Without such economic activity, these critical infrastructures would not exist.

Scarcity and the Basic Economic Problem

Economics, at its core, is about making choices. It’s a field that’s centred around a fundamental problem: How do we best use our limited resources to fulfill our unlimited wants and needs? This dilemma, known as the basic economic problem, stems from the concept of scarcity. Let’s unpack these ideas.

What is Scarcity?

Scarcity, in an economic context, is the basic economic problem that arises because people have unlimited wants but resources are limited. Because of scarcity, choices must be made by consumers, businesses, and governments.

For example, a typical family may want to buy a new car, renovate their home, take a vacation, and pay for college tuition. However, their resources—primarily their income—are limited, so they can’t do everything they want. They have to make choices on how to best use their limited resources to fulfill their most important wants and needs.

The Basic Economic Problem: Making Choices

Scarcity leads us to the basic economic problem: the question of how to best allocate and use resources to satisfy as many of our needs and wants as possible. To put it simply, the basic economic problem is about dealing with scarcity and making choices.

For a family, this might involve creating a budget to decide how to spend their income. For a business, it might mean deciding whether to invest profits back into the business or to give them to shareholders as dividends. For a government, it can involve choosing how to use tax revenue—for education, healthcare, defense, or other services.

How Scarcity Influences Decisions

The concept of scarcity is central to how we make decisions in various aspects of our lives. It’s why we have to make decisions about what to buy, what job to take, or even what to do in our free time.

In the business world, scarcity drives innovation and efficiency. Businesses are constantly striving to do more with less—less time, less money, and fewer resources. They use techniques like lean manufacturing and Six Sigma to eliminate waste and increase productivity.

On a larger scale, governments must deal with scarcity when deciding how to allocate resources for public services. This often involves making tough decisions about what services are most essential and what sectors of the population are most in need.

The Key Economic Decisions

In the world of economics, every decision is like a puzzle piece. From choosing the kind of breakfast cereal to buy, to a government’s decision to build a new hospital or a business’s decision to invest in a new technology – each decision plays a part in forming the overall economic picture. But with scarcity being a fundamental economic problem, the choices aren’t always easy. Let’s explore the three key economic decisions that societies must continually make.

What to Produce?

First up is deciding what goods and services to produce. This sounds straightforward, but remember, resources are limited while our wants and needs are essentially unlimited. Should a clothing company make more jeans or t-shirts? Should a country invest more in education or healthcare? These questions hinge on determining what is needed most and what can be produced efficiently.

For example, a society where most citizens are young might choose to allocate more resources towards education. A clothing company, after analyzing market trends, may decide to produce more t-shirts due to higher demand.

How to Produce?

Once we’ve decided what to produce, the next question is how to produce it. This involves choosing the most effective production methods that make the best use of resources. Should a car manufacturer use human labor or invest in automated machinery? Should a bakery rely on traditional baking techniques or more modern, industrial ones?

The answers depend on various factors such as the available technology, cost of labor, and the environmental impact. For instance, a company may choose to use automated machinery if it’s cheaper and more efficient, but this could lead to job losses.

For Whom to Produce?

The final key economic decision is determining who gets to use the goods and services that have been produced. Who should have access to healthcare? Who gets to buy the t-shirts that a company makes?

In a market economy, this is often decided by consumers’ purchasing power. Those who can afford a product or service get to use it. However, for essential services like healthcare and education, governments often step in to ensure that even those who can’t afford it have access.

The Main Economic Groups

The world of economics can sometimes seem like a complex and intricate dance, with different groups interacting in myriad ways to create, distribute, and consume goods and services. To understand this dance, we need to understand its main participants: consumers, producers, and the government. Let’s delve into the roles and interactions of these key economic groups.

Consumers

Consumers, quite simply, are the individuals or groups who consume goods and services. They are the ones who demand products, from basic necessities like food and clothing, to luxury items like sports cars and vacations. Consumers play a crucial role in the economy by influencing what is produced based on their needs, wants, and purchasing power. Their spending also helps stimulate economic activity and growth.

Producers

Producers are the individuals or entities that create goods or provide services. This group includes everyone from the local baker to multinational corporations. Producers respond to consumers’ demands and try to provide the goods and services that consumers want, while aiming to make a profit. Producers also play a role in driving innovation, as they seek to improve products and services to gain a competitive edge in the market.

Government

The government plays a multifaceted role in the economy. It acts as a producer of public goods and services, such as roads, schools, and healthcare. It’s also a consumer, buying goods and services from producers. Moreover, the government acts as a regulator and referee, setting the rules that guide economic activity. It can influence the economy through policies related to taxation, spending, and interest rates.

The Interactions Between These Groups

These three main economic groups are interconnected, each influencing and being influenced by the others. For example, consumers demand goods and services, influencing what producers choose to create. Producers, in turn, supply goods and services, which consumers use.

The government interacts with both consumers and producers. It regulates producers through laws and guidelines to ensure fair competition and protect consumers. Meanwhile, it also provides public goods and services for consumers, paid for through taxes collected from both consumers and producers.

Furthermore, these groups can impact each other indirectly. For instance, if consumers demand more eco-friendly products, producers may alter their manufacturing practices, leading to changes in employment rates, resource usage, and possibly even government regulations.

The Factors of Production and Their Rewards

Imagine you’re baking a cake. You’d need a few key ingredients: flour, sugar, eggs, and perhaps some chocolate for good measure. In the world of economics, creating goods and services also requires certain key ‘ingredients’. These are called the factors of production, and they include land, labor, capital, and enterprise. Let’s learn about these factors and the rewards associated with each of them.

Land

Land refers to natural resources used in the production process. This includes not only physical land and plots but also water, oil, minerals, and even the air we breathe.

In return for the use of land, the landowner is rewarded with rent. The concept of rent in economics extends beyond just payment for using a piece of land. It includes any income received from natural resources. For example, if you own a piece of land rich in oil and a company pays you to extract that oil, that payment is considered rent.

Labor

Labor involves the physical and mental efforts that people contribute to the production of goods and services. This includes everything from the manual labor of a construction worker to the intellectual labor of a software engineer.

The reward for labor is wages. Wages compensate workers for their time, effort, skills, and expertise. This compensation can take various forms, including hourly pay, salaries, and even bonuses.

Capital

In economics, capital refers to the man-made physical goods used in production. This includes machinery, buildings, and tools. For example, the oven and mixers a baker uses to make bread would be considered capital.

The reward for using capital is interest. When business owners invest in capital, they often use their own funds or borrow money. The return they get on this investment, or the payment they make on borrowed funds, is interest.

Enterprise

Enterprise, also known as entrepreneurship, is the factor that brings the other three factors together. It involves taking on risk to start a business, innovate, and seek profit. An entrepreneur, for example, might use land, labor, and capital to start a bakery.

The reward for enterprise is profit. Profit is the financial gain entrepreneurs receive when their revenue (the money they make from selling goods or services) exceeds their costs (the money they spent on land, labor, and capital).

Making Choices and Understanding Opportunity Cost

Life is full of choices. Do you go to the gym or stay in and watch a movie? Should you save your money or splurge on a new phone? In economics, making choices is central to the study of how individuals and societies manage resources. One key concept in making these choices is the idea of opportunity cost. Let’s dive deeper into these ideas and see how they affect our decisions.

The Act of Making Choices

Economic choices involve deciding how best to use limited resources to satisfy unlimited wants and needs. This could mean a family deciding how to spend their income, a business deciding how to use their profits, or a government deciding how to use tax revenues.

For example, if a family has a budget of $500 for recreation, they might have to choose between a weekend trip to the beach or buying a new television. A business, with a set budget for expansion, might have to decide between opening a new store or investing in online sales.

The Concept of Opportunity Cost

Opportunity cost is a fundamental concept in economics that refers to the potential benefit an individual, investor, or business misses out on when choosing one alternative over another.

In essence, it’s the “cost” you “pay” for making a certain choice, in terms of the opportunities you give up. So, when we talk about opportunity cost, we’re really talking about what you’re missing out on.

Let’s go back to our examples. If the family chooses the beach trip, the opportunity cost is the enjoyment they could have gotten from the new television. If the business decides to invest in online sales, the opportunity cost might be the potential revenue from the new store.

Why Understanding Opportunity Cost is Important

Understanding opportunity cost can help us make better decisions. It reminds us that the real cost of something is more than just its price tag. It’s also about what we give up when we make a choice.

Opportunity cost can also help us think about the value of time. For example, the time you spend watching a movie is time you can’t spend doing something else. So, the opportunity cost of watching the movie might be a missed workout at the gym, time you could have spent working on a side project, or a chance to hang out with friends.

Role of Government in Economics

In the vast, bustling marketplace of an economy, there’s one player that has the ability to influence everyone else: the government. Whether by laying down the rules of the game, stepping in as a player itself, or acting as a referee, the government plays multiple crucial roles in economics. Let’s dive into what these roles entail and how they impact our daily lives.

Government as a Provider of Public Goods and Services

Firstly, the government is a provider of public goods and services. Public goods are goods that are non-excludable (everyone can use them) and non-rivalrous (one person’s use doesn’t reduce availability to others). Examples include street lighting, public parks, and national defense. Since these goods wouldn’t be provided adequately in a free market, the government steps in to ensure their availability.

Similarly, the government also provides essential services such as healthcare and education. While these services can and do exist in the private market, the government provides them as well to ensure accessibility for everyone, regardless of their ability to pay.

Government as a Regulator

The government also acts as a regulator of economic activity. This means setting the rules of the game. It enacts laws and regulations related to everything from worker safety and minimum wages, to pollution limits and consumer protection. These rules are designed to ensure fair competition, protect consumers and workers, and prevent harmful practices.

Government as a Redistributor of Income

The government plays a role in redistributing income in society to reduce economic inequality. This is done through taxation and welfare programs. Higher income groups are taxed more, and these funds are used to provide welfare benefits to lower-income groups. This could include unemployment benefits, housing assistance, or subsidized healthcare.

Government as a Stabilizer of the Economy

Finally, the government acts as a stabilizer of the economy. It uses fiscal policy (changes in government spending and taxes) and monetary policy (manipulating interest rates and the money supply) to smooth out economic fluctuations. The goal is to maintain steady growth, keep unemployment low, and keep inflation at a moderate level.

The Production Possibility Frontier (PPF)

In the world of economics, we often have to make choices about how to best use our limited resources. But how can we visualize these choices and the trade-offs they involve? Enter the Production Possibility Frontier (PPF), a powerful tool that helps us understand the concept of scarcity, trade-offs, and efficiency. Let’s take a closer look at this economic concept.

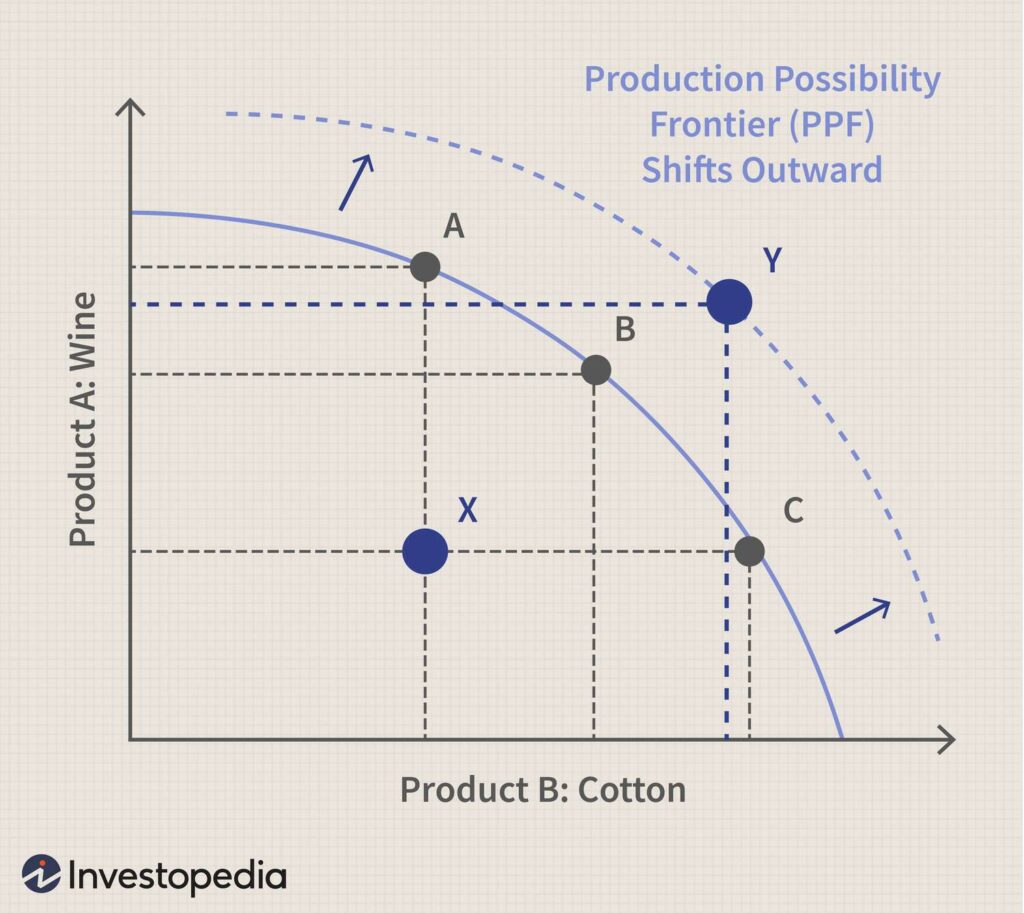

What is the Production Possibility Frontier?

The Production Possibility Frontier (PPF) is a graph that shows the different quantities of two goods that an economy can produce using its resources efficiently. On the graph, one good is on the x-axis and the other on the y-axis. The curve (or frontier) shows the maximum possible output for each good, given the output of the other good.

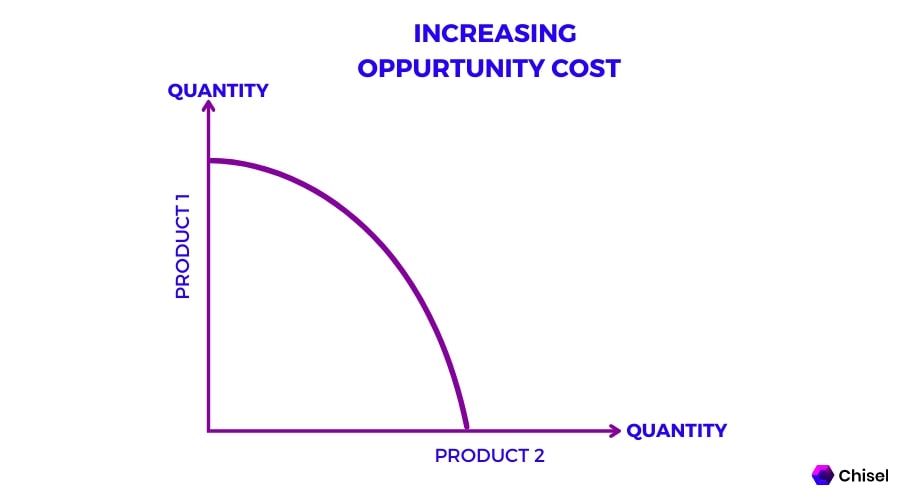

The Concept of Trade-offs and Opportunity Cost

The PPF illustrates the concept of trade-offs and opportunity cost. Because resources are limited, producing more of one good means producing less of the other. This is the trade-off. The opportunity cost is what we give up to get more of the other good.

For instance, let’s imagine an economy that only produces two goods: robots and pizzas. The PPF would show the maximum number of robots and pizzas that can be produced. If the economy is at a point on the PPF where it’s producing many robots but few pizzas, and it decides to produce more pizzas, it will have to produce fewer robots. That’s the trade-off. The opportunity cost of more pizzas is fewer robots.

Efficiency, Inefficiency, and Economic Growth

The PPF also illustrates concepts of efficiency, inefficiency, and economic growth. Points on the PPF curve represent efficient production – the economy is maximizing its output given its resources. Points inside the PPF represent inefficiency – the economy could produce more of both goods without giving up anything.

Economic growth can be represented by an outward shift of the PPF. This could be due to factors like technological progress or increase in resources, which would allow the economy to produce more of both goods.

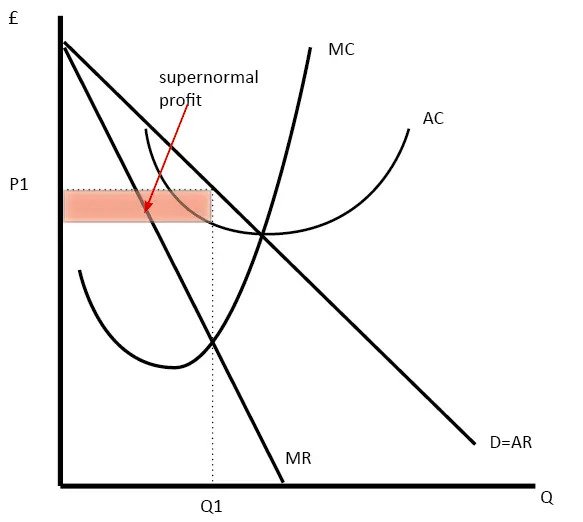

Market Types

Have you ever wondered why you can choose between dozens of different smartphone brands, but in most places, you have only one choice for your water supply? This has to do with the different types of markets that exist in the economy. From perfectly competitive markets to monopolies, let’s take a look at the various market structures and how they operate.

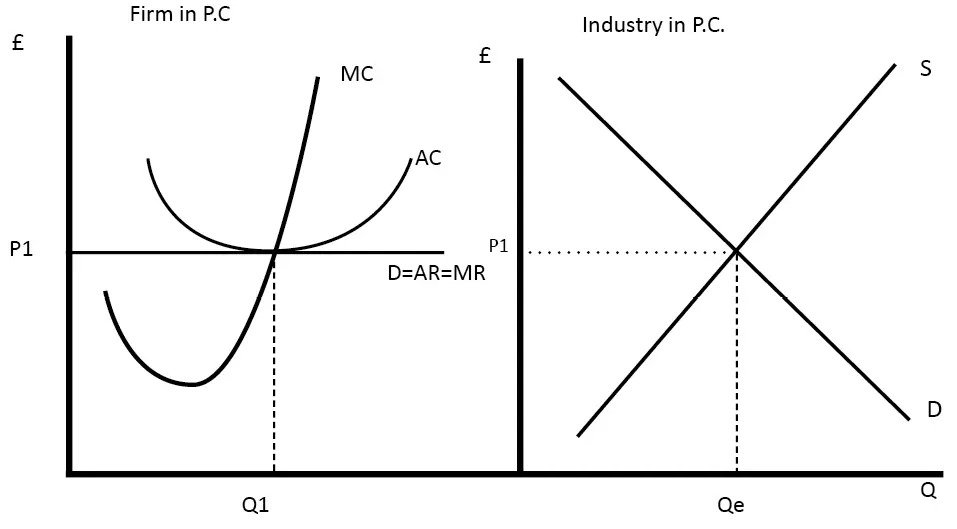

Perfect Competition

In a perfectly competitive market, there are many buyers and sellers, and they all sell an identical product. No single buyer or seller can influence the market price, and they must accept the price determined by the market. Examples are rare but could include markets for agricultural commodities like wheat or corn.

In this market type, consumers have the most power because if one firm tries to increase prices, consumers can easily switch to another seller. Therefore, firms in a perfectly competitive market are ‘price takers’.

Monopolistic Competition

In a monopolistically competitive market, there are many buyers and sellers, but the products are not identical. They are differentiated, meaning each product has unique characteristics that distinguish it from others. Think of fast food restaurants, for example: each one offers different menus, environments, and services.

Firms in monopolistic competition have some control over their prices because of product differentiation. Consumers might be willing to pay more for a product if they perceive it as better or more desirable than others.

Oligopoly

An oligopoly market is dominated by a few large sellers. Because there are only a few players, each one can influence the market price. Each firm’s decision affects the others, leading to a high degree of interdependence. An example of an oligopoly might be the market for commercial aircraft, which is dominated by Boeing and Airbus.

In an oligopoly, barriers to entry are typically high, preventing new competitors from entering the market. This could be due to high startup costs, control over key resources, or government regulations.

Monopoly

A monopoly exists when a single company controls the entire market for a product or service. This could be because the company owns all the resources, has a patent, or because the government has granted them exclusive rights to supply a particular good or service. A typical example would be a utility company, like a water supplier.

In a monopoly, the firm has significant control over the price, since consumers have no alternatives. Monopolies can lead to high prices and limited output, which is why they are often regulated by the government.

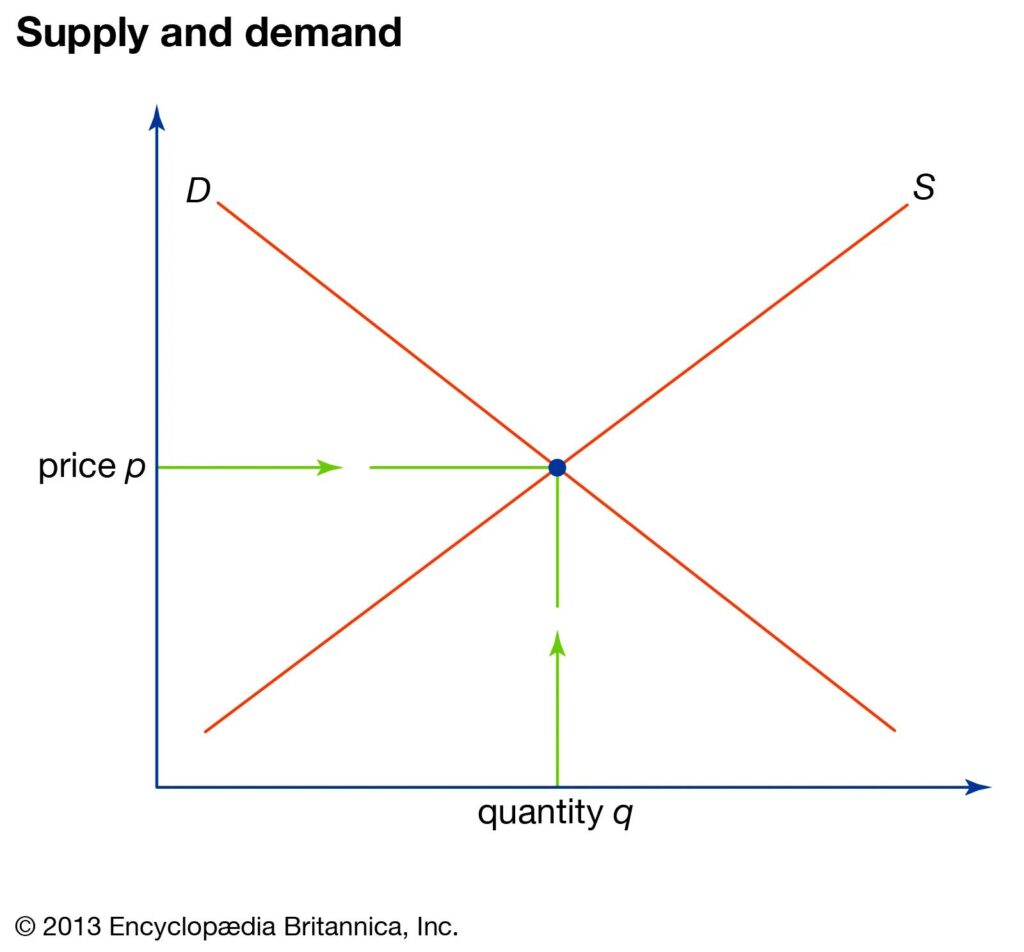

Supply and Demand

Imagine you’re at a bustling marketplace where goods are being exchanged left and right. Prices are going up and down, and people are haggling over their purchases. What drives these movements and negotiations? The fundamental forces at work are supply and demand. Let’s dig into these concepts and their role in shaping our economies.

Understanding Demand

Demand refers to how much of a product consumers are willing and able to buy at various prices. It’s determined by factors like income, tastes and preferences, the prices of related goods, and expectations about future prices. Generally, if a product’s price drops, people will demand more of it, and vice versa. This relationship is represented by the demand curve, which is usually downward sloping.

For instance, imagine you love apples. If the price of apples decreases, you would probably buy more apples than before. That’s the law of demand in action!

Grasping Supply

On the flip side, supply refers to how much of a product producers are willing and able to sell at different prices. It’s influenced by factors like production costs, technology, the prices of related goods, and expectations about future prices. Typically, if the price of a product rises, producers are willing to supply more of it, and vice versa. This is illustrated by the upward-sloping supply curve.

Take the apple example again. If the price of apples rises, apple farmers would be motivated to sell more apples because they can earn more profit. This is the law of supply!

Equilibrium: Where Supply Meets Demand

When the quantity demanded of a product equals the quantity supplied, we reach a state of equilibrium. This is the point where the supply and demand curves intersect. The price at this point is the equilibrium price, and the quantity is the equilibrium quantity.

In our apple market, if farmers supply just the right amount of apples that consumers want to buy, we’ve hit the equilibrium. The price at which apples are sold and the number of apples exchanged would be the equilibrium price and quantity.

Conclusion

In conclusion, supply and demand are fundamental concepts in economics that help us understand how markets work. They determine the prices of goods and services and the quantities that are produced and consumed. By understanding supply and demand, we can make sense of market movements, price changes, and economic patterns. These forces are at work in every transaction we make, from the grocery store to the stock market!

Positive and Normative Economics

In our quest to understand economics, we often stumble upon two different viewpoints: positive economics and normative economics. While both are integral parts of economic science, they each provide a distinct perspective on how we study and understand economic phenomena. Let’s unpack these concepts and see how they shape our understanding of economics.

Positive Economics: The ‘What Is’

Positive economics is the branch of economics that involves the description, collection, and analysis of data to explain how the economy works. It deals with objective facts and cause-and-effect relationships. In other words, positive economics tells us ‘what is’.

For example, a positive economic statement might be: “When the price of apples rises, people buy fewer apples.” This statement is factual and testable. We can collect data on apple prices and apple sales and see if the relationship holds true.

Normative Economics: The ‘What Ought to Be’

On the other hand, normative economics involves judgments and opinions about the economy. It’s concerned with economic policies and propositions about how the economy ‘ought to be’. Normative economics often involves value judgments and subjective statements about economic fairness or what the desired outcome of certain policies should be.

For example, a normative economic statement might be: “The government should lower taxes to increase people’s disposable income.” This statement is based on a value judgment (that it’s good to increase people’s disposable income) and is not objectively testable.

The Intersection of Positive and Normative Economics

While it’s important to differentiate between positive and normative economics, they often intersect. Economists use positive economics to understand how the world works, and then they use normative economics to make recommendations for how to improve it.

For example, an economist might use positive economics to understand the impact of a tax cut (who benefits, how much they benefit, what the effect is on the budget deficit), and then use normative economics to assess whether the tax cut is a good idea (whether the benefits outweigh the costs, who should bear the burden of taxation).

What is the difference between a need and a want? Provide an example of each.

A need is something essential for survival, such as food or water. A want is something desired for comfort or pleasure but not essential for survival, such as a luxury car or a vacation.

Explain the central purpose of economic activity.

The central purpose of economic activity is to produce goods and services to satisfy needs and wants.

What is the basic economic problem? How does it relate to scarcity and choice?

The basic economic problem is how to allocate scarce resources to satisfy unlimited wants. This creates the need for choice – deciding how to best use these resources to satisfy as many wants as possible.

Identify and describe the key economic decisions every society must make.

Every society must make decisions about what to produce (which goods and services to create), how to produce (what combination of resources to use), and for whom to produce (who gets to consume the goods and services).

Who are the main economic groups, and how do they interact?

The main economic groups are consumers, producers, and the government. Consumers demand goods and services; producers supply them. The government regulates interactions between consumers and producers and provides public goods and services.

What are the factors of production? Provide an example and the corresponding reward for each.

The factors of production are land (natural resources, rewarded by rent), labor (human work, rewarded by wages), capital (machinery and tools, rewarded by interest), and enterprise (risk-taking and organization, rewarded by profit).

Explain the concept of opportunity cost and provide an example.

Opportunity cost is the next best alternative foregone when a choice is made. For example, if you spend your time studying for an exam, the opportunity cost could be the leisure time you give up.

Describe the different market structures and provide an example for each.

Perfect competition (many buyers and sellers, identical products, e.g., agricultural commodities), monopolistic competition (many sellers, differentiated products, e.g., fast food restaurants), oligopoly (few large sellers, e.g., airlines), monopoly (single seller, e.g., local utility companies).

Explain the concept of the Production Possibility Frontier (PPF) and what it illustrates.

The PPF is a curve that shows the maximum combination of two goods an economy can produce using its resources efficiently. It illustrates the concepts of scarcity, choice, opportunity cost, and trade-offs.

Distinguish between positive and normative economics with examples.

Positive economics deals with objective, factual, and testable statements about the economy (‘what is’, e.g., “When the price of apples rises, people buy fewer apples”). Normative economics involves subjective judgments about what the economy should be like (‘what ought to be’, e.g., “The government should reduce taxes to increase people’s disposable income”).