Understanding Resource Allocation

Imagine you’re planning a big birthday bash with a set budget. How much do you spend on food, decorations, entertainment, and gifts? This challenge, where you need to spread a limited amount of money across different needs, is a simple example of ‘Resource Allocation’.

The Basics of Limited Resources

At its core, resources are anything we use to produce or accomplish something. This could be time, money, labor, or materials. The challenge is that these resources are often limited. For instance, there are only 24 hours in a day, a finite amount of money in our bank accounts, and limited raw materials on Earth. So, the big question is: how do we distribute these limited resources to satisfy our many wants and needs?

The Movie Budget Analogy

Let’s take the scenario of directing a movie with a fixed budget. You have to decide on actors, scripts, locations, and equipment. If you hire a top-tier actor, there might be less left for high-quality equipment or locations. This scenario mirrors how economies have to decide on resource allocation: what gets produced, how it’s produced, and who gets the end product.

Prices as Allocation Signals

Prices play a pivotal role in our everyday decisions. If the price of coffee beans soars due to a shortage, a cafe might choose to promote teas or other beverages more heavily. This is an example of resource allocation in action. The increasing price indicates scarcity, prompting businesses to adapt and consumers to reconsider their choices.

Why Resource Allocation Matters

Grasping the concept of resource allocation is essential because it influences our daily lives. The cost of products we buy, the availability of services, or even job opportunities in our areas often come down to decisions made based on resource allocation. When you’re weighing whether to invest time in a new hobby or work on a home project, you’re facing a resource allocation decision, albeit on a personal level.

Markets

A market, at its essence, is a meeting point where buyers and sellers converge to exchange goods, services, or resources. But there’s more to it than just that.

Nature of Markets

While many of us might picture bustling bazaars or neatly organized supermarket aisles, in the modern era, a market doesn’t necessarily have to be a physical entity. Think of the vast online marketplaces like Amazon or even digital spaces where stocks, currencies, and cryptocurrencies are traded.

The Core Purpose

Why do markets exist? To simplify trade. If you’ve ever tried to swap items directly (say, trading your skateboard for a friend’s rollerblades), you’ve engaged in barter. But barter can be complicated, requiring a double coincidence of wants. Markets, especially money-based ones, remove this complexity. You sell your goods or services to those who want them, get money in return, and then use that money to buy something you want.

The Price Magic

One of the most vital functions of a market is to determine the price of a product or service. This is achieved through the balancing act of supply and demand. If a newly released book becomes incredibly popular and stocks are running low, the price might surge. Conversely, if a type of fruit is overly abundant and there’s more supply than demand, you might find it on a discount.

Efficient Distribution

Markets play a pivotal role in ensuring resources and products reach those who value them most. For instance, when concert tickets are being sold, they’ll likely be purchased by those most eager to attend and willing to pay the asking price.

Key Information

- A market is more than just a space; it’s a mechanism that simplifies trade, sets prices, and efficiently distributes resources.

- While physical markets are still widespread and crucial, digital marketplaces are becoming increasingly prominent.

- The interplay of supply and demand in markets determines prices, guiding producers and consumers in their decisions.

Allocation of Resources in Markets

Resource allocation in markets is essentially about how goods, services, and inputs are distributed among individuals and businesses. It’s a dynamic process, shaped by numerous factors.

Signals and Incentives

In market economies, the price acts as both a signal and an incentive. When there’s a sudden demand for a particular item, say, hand sanitizers, their prices tend to go up. This spike in price signals to producers that there’s a high demand, suggesting they should produce more. It also provides an incentive; producing more might mean higher profits given the increased willingness of consumers to buy.

Adapting to Changes

Markets are constantly evolving and adapting to shifts in consumer preferences, technological advancements, and other external influences. If a new health study promotes the benefits of a certain superfood, markets might respond by allocating more resources towards its production and distribution. Similarly, if technological advancements make electric cars more viable and affordable, resources might shift away from traditional petrol car production.

Limitations of Market Allocation

Markets are incredibly efficient at responding to supply and demand, but they don’t always account for broader societal needs. Essential services like education or healthcare might not be adequately provided in purely market-driven economies. This is because markets prioritize profit and may overlook services that, while essential, aren’t always lucrative.

Furthermore, markets can sometimes lead to inequalities. For instance, if demand for a particular skill set skyrockets, individuals with those skills might experience wage increases, while those without might face stagnation or even decreases.

Government Intervention

Recognizing these limitations, governments often step in to regulate or directly participate in certain markets. This can involve subsidizing essential but underprovided services, taxing harmful products, or implementing policies to reduce market-driven inequalities.

Key Information

- Allocation of resources in markets is majorly influenced by the interplay of supply and demand, with prices acting as signals and incentives.

- While markets can swiftly adapt to changes, they might not always cater to the broader societal needs.

- Government interventions are common in many markets to ensure equitable outcomes and to address potential market failures.

Factor vs. Product Markets

Navigating the world of economics means understanding various market types and how they operate. Among them, the distinctions between factor and product markets stand out as particularly significant. So, let’s delve into what these markets are and how they differ.

Factor Markets

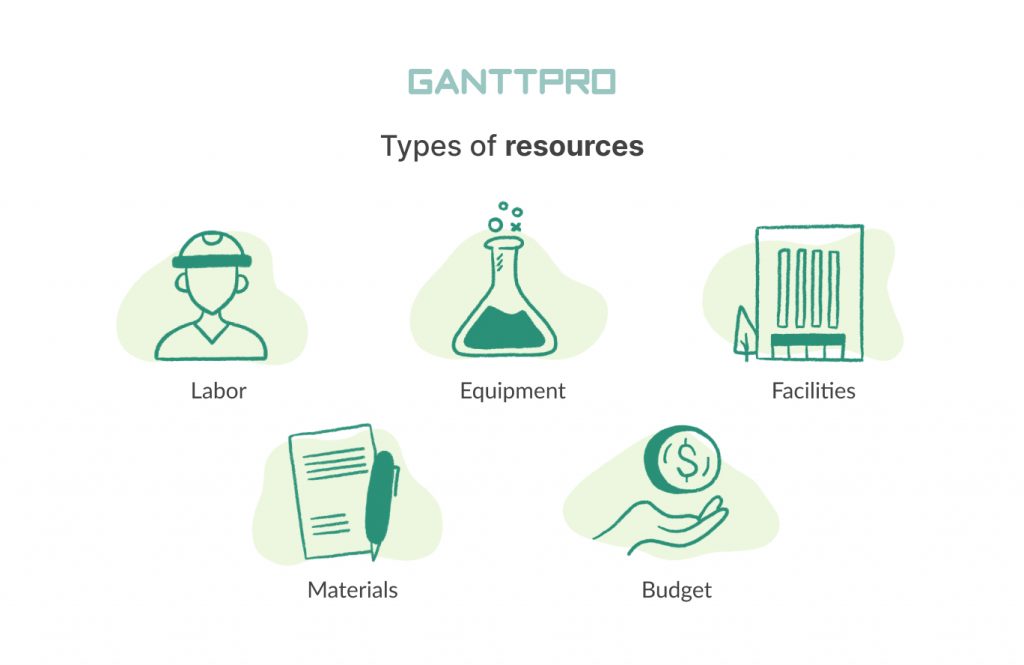

Factor markets, sometimes referred to as input or resource markets, deal with the resources required for production. In essence, these are the markets where producers acquire what they need to produce goods and services. The main factors of production include:

- Labor: This refers to the work done by people in producing goods and services. When you’re hired by a company, you’re essentially selling your labor in the factor market, and the company is buying it.

- Capital: This isn’t just about money. In economics, capital refers to tools, machinery, and any other goods used in the production of other goods and services.

- Land: This includes not only the ground itself but also the natural resources upon or beneath it, such as minerals, water, and oil.

- Entrepreneurship: Entrepreneurs take on the risks of merging the other three factors to produce goods and services, aiming for a profit.

Product Markets

Product markets are where finished goods and services are bought and sold. This is the market most consumers are familiar with. Whether you’re buying a book, a coffee, or getting a haircut, you’re participating in the product market. Here, producers sell their goods and services directly to the consumer. The money that consumers spend becomes revenue for the producers, which they then use to buy more resources from the factor markets, creating a continuous economic loop.

The Interplay

It’s essential to grasp the symbiotic relationship between factor and product markets. They feed into each other in an ongoing cycle. Producers buy resources from the factor market, create products, and then sell these products in the product market. The revenue they gain from the product market can then be used to buy more resources from the factor market, and the cycle continues.

Key Information

- Factor markets deal with the resources required for production, such as labor, capital, land, and entrepreneurship.

- Product markets are where finished goods and services are traded, directly influencing consumer choices.

- There’s a continuous loop between these two markets, ensuring the flow of goods, services, and resources in the economy.

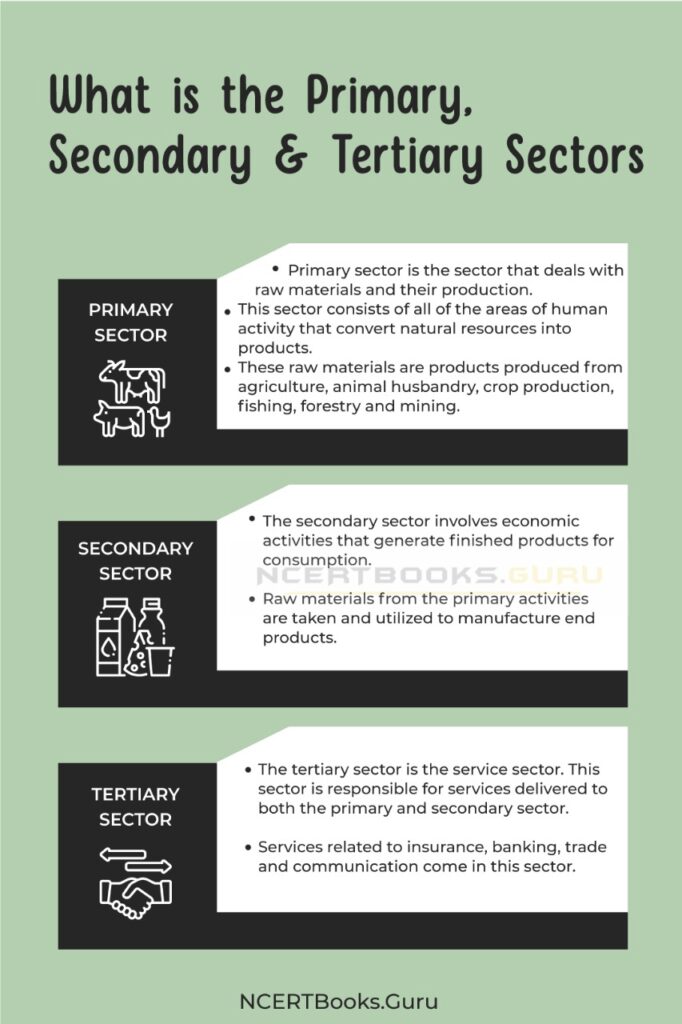

Primary, Secondary, and Tertiary Sectors

The economic activities of a country or region can be broadly categorized into three sectors: primary, secondary, and tertiary. These sectors represent different stages in the production and distribution of goods and services. To paint a clearer picture, let’s dive into each sector and its unique characteristics.

Primary Sector

The primary sector is all about raw materials and natural resources. Think of activities that involve extracting or harvesting resources directly from the earth or water. Examples include:

- Agriculture: Farming crops like wheat, rice, and maize.

- Forestry: Harvesting timber for various purposes, from construction to paper production.

- Fishing: Catching fish from oceans, seas, or freshwater bodies.

- Mining: Extracting minerals like coal, gold, or diamonds from beneath the earth’s surface.

The primary sector forms the base of the production process, as it provides the raw materials needed for the subsequent sectors.

Secondary Sector

This sector takes the raw materials from the primary sector and transforms them into finished or semi-finished products. It’s the manufacturing and construction hub of the economy. Activities here include:

- Manufacturing: Converting raw materials into products, such as turning cotton into clothing or metal into automobiles.

- Construction: Building infrastructure like roads, bridges, and houses.

- Energy production: Converting resources like coal, oil, or wind into electricity.

Tertiary Sector

The tertiary sector is a shift from goods to services. It’s the segment of the economy that offers services instead of tangible products. This encompasses a vast range of activities, including:

- Retail: Selling goods directly to consumers, from grocery stores to online marketplaces.

- Transportation: Services that move people and goods from one place to another.

- Education: Schools, colleges, and other educational institutions.

- Healthcare: Hospitals, clinics, and healthcare professionals.

- Financial Services: Banking, insurance, and investment services.

As economies develop, there’s often a shift from primary and secondary activities to tertiary ones, reflecting a move towards a service-based economy.

Key Information

- The primary sector is focused on extracting raw materials and resources directly from nature.

- The secondary sector revolves around transforming these raw materials into finished or semi-finished products.

- The tertiary sector represents the service-based segment of the economy, covering everything from retail and transportation to education and healthcare.

- As economies evolve, the balance between these sectors can shift, reflecting broader socio-economic trends and developments.

Goods vs. Services

As we interact with the world around us, we often buy things or pay for certain activities. These transactions usually involve either goods or services. But what exactly differentiates these two? Let’s delve into their distinct characteristics and examples to understand them better.

Goods

Goods are tangible items that can be seen, touched, and physically possessed. They are products that meet consumers’ needs and wants. Once you purchase a good, you own it, and it’s yours to keep, use, or even resell.

- Examples of Goods:

- Durable Goods: These are goods that last for a considerable amount of time and do not wear out quickly. Think of products like cars, refrigerators, and laptops.

- Non-Durable Goods: Items that are consumed quickly and need to be replaced frequently fall under this category. Examples include food, drinks, and stationery.

Services

Services, on the other hand, are intangible activities or benefits that one party can offer to another. Unlike goods, services are not things you can hold in your hand, and they’re often consumed at the point of sale. When you pay for a service, you’re essentially paying for knowledge, expertise, skill, or convenience.

- Examples of Services:

- Professional Services: This encompasses jobs like lawyers, doctors, accountants, and consultants who offer specialized knowledge and skills.

- Utility Services: Providing electricity, water supply, or internet connectivity falls under this category.

- Recreational Services: When you watch a movie in a cinema or dine out in a restaurant, you’re paying for recreational services.

The Blurred Line

In some instances, goods and services are so intertwined that they might seem inseparable. For instance, when you buy a smartphone (a good), it often comes with a warranty or after-sales service. Similarly, when you stay at a hotel, you’re paying for the physical room (a good) and the hospitality service.

Key Information

- Goods are tangible items that you can physically possess, while services are intangible activities or benefits provided to consumers.

- Examples of goods include cars, books, and groceries, whereas services encompass activities like legal advice, medical treatment, and entertainment.

- Some offerings combine both goods and services, illustrating the interconnected nature of these two economic components.

Specialisation and Division of Labour

Within the vast landscape of economics and production, the concepts of specialisation and division of labour emerge as key pillars, driving efficiency and innovation. These principles have significantly influenced the way goods and services are produced and exchanged. So, what exactly are these concepts, and why are they so crucial?

Specialisation

Specialisation refers to the process where individuals, businesses, regions, or countries focus on producing a limited range of products or services. This concentration allows them to become more skilled and efficient in that specific domain, often leading to higher quality outputs and greater productivity.

- Individual Specialisation: A software developer might specialise in a particular programming language, becoming an expert in creating specific types of applications.

- Regional or Country Specialisation: Certain regions might have natural advantages or resources that allow them to specialise. For example, France might specialise in wine production, while Japan may focus on electronics manufacturing.

The rationale behind specialisation is that by concentrating on what you do best and trading for the rest, overall productivity and efficiency can be maximised.

Division of Labour

Closely related to specialisation is the division of labour. It entails breaking down a production process into distinct tasks, each performed by a different worker or group of workers. Instead of one person crafting an entire product, multiple individuals each handle a specific part of the production.

- Example: Consider the assembly line for a car. One group might be responsible for installing the engine, another for fitting the tires, and yet another for painting the car’s exterior. Each group specialises in one task, improving the overall efficiency and speed of the car’s production.

Benefits of Specialisation and Division of Labour

- Increased Efficiency: As workers focus on specific tasks or products, they become more skilled and faster at performing them.

- Higher Quality: Specialisation often leads to higher levels of expertise, translating into better quality products or services.

- Economic Growth: Increased efficiency and productivity can contribute to overall economic growth and prosperity.

Costs of Specialisation and Division of Labour

- Dependence: Over-specialisation can make economies vulnerable. If a country relies too heavily on one product and demand for that product drops, it can lead to economic hardships.

- Loss of Flexibility: Workers who are overly specialised might find it challenging to adapt to changes in technology or market demand.

- Monotony of Work: For some workers, doing the same task repeatedly can become monotonous and lead to decreased job satisfaction.

Key Information

- Specialisation and division of labour are principles designed to enhance efficiency and productivity in the production process.

- By focusing on specific tasks or products, individuals and regions can maximise their expertise and outputs.

- However, while there are undeniable benefits, over-specialisation and repetitive tasks can also have drawbacks, highlighting the need for a balanced approach.

Benefits of Specialisation and Division of Labour

While the concepts of specialisation and division of labour often go hand in hand, understanding their benefits is crucial to grasp why they play such a pivotal role in economic growth and development. Let’s explore the numerous advantages these principles bring to the table.

Efficiency Boost

One of the most apparent benefits of specialisation and division of labour is the significant increase in efficiency. When workers or entities focus on a specific task or set of tasks:

- They become more skilled and faster in those tasks due to repetition and practice.

- Less time is wasted switching between different activities, leading to a smoother production process.

Quality Enhancement

By specialising, individuals or firms can hone their skills, often leading to:

- Greater expertise and precision.

- Reduced error rates and higher-quality outputs.

For example, a tailor specialising in wedding dresses will likely produce a higher-quality dress than a general clothing manufacturer.

Innovation and Advancement

When entities specialise, there’s a deeper focus on a particular field or task, often leading to:

- In-depth research and exploration.

- Development of new techniques or technologies to enhance the production process.

For instance, a tech company that specialises in camera technology might innovate faster than a general tech firm.

Economic Growth

Both specialisation and division of labour play a vital role in economic growth:

- They allow for larger scale production, leading to economies of scale.

- With increased production and exports, countries can see an upsurge in GDP.

Optimal Resource Utilisation

Specialisation often means entities are producing what they’re best at. This ensures:

- Resources, both human and material, are used optimally.

- Wastage is minimised, leading to cost savings.

Enhanced Consumer Choices

With specialisation, firms can offer a wider variety of products:

- Consumers benefit from a diverse range of products tailored to their specific needs.

- It fosters competition, which can lead to better quality and lower prices.

Facilitated Trade

Countries often specialise based on their resources or skills and then trade with other nations:

- This exchange allows nations to enjoy goods and services they might not efficiently produce domestically.

- Global trade connections are strengthened, benefiting economies worldwide.

Key Information

- Specialisation and division of labour are foundational concepts in economics, driving efficiency, quality, and growth.

- Their benefits extend beyond production, influencing trade, consumer choice, and even fostering global connections.

- By focusing on specific tasks or areas of production, both individuals and nations can maximise their potential and enjoy diverse economic advantages.

Costs of Specialisation and Division of Labour

While specialisation and division of labour undoubtedly offer numerous benefits, it’s essential to understand the potential drawbacks or costs associated with these principles. By identifying these challenges, economies and businesses can better navigate the complexities of the production landscape.

Over-dependence

Specialisation can lead to an over-reliance on specific products or sectors:

- If there’s a sudden drop in demand for that product or a disruption in production, it can pose significant economic risks.

- For example, a country specialising in oil exports might face challenges if global oil prices plummet.

Reduced Flexibility

With a narrow focus on particular tasks or products:

- Workers or industries might find it challenging to adapt to new technologies or shifts in market demands.

- A firm specialising in manufacturing VHS players, for instance, would have faced challenges during the transition to DVDs and streaming services.

Monotony and Job Dissatisfaction

Repetitive tasks can lead to boredom and decreased job satisfaction:

- Workers doing the same task continuously might experience burnout or reduced motivation.

- This could potentially result in lower productivity or higher employee turnover.

Potential for Inequities

The benefits of specialisation and division of labour might not be evenly distributed:

- Certain sectors or groups may accrue more wealth and power, leading to socio-economic disparities.

- For instance, while tech hubs might thrive, regions focused on declining industries might face economic hardships.

Vulnerability to External Shocks

Specialisation can expose economies to external shocks:

- Natural disasters, political instabilities, or global economic downturns can severely impact countries heavily reliant on a single export product.

Loss of Diverse Skill Sets

By focusing solely on a specific task or skill:

- Workers might lose out on developing a diverse skill set, limiting their employment opportunities in a dynamic job market.

- An assembly line worker might face challenges in finding employment outside their specific task if the factory shuts down.

Environmental Concerns

Specialisation, especially in resource-intensive sectors, might lead to:

- Over-exploitation of resources.

- Environmental degradation if sustainable practices aren’t followed.

Key Information

- The costs of specialisation and division of labour underscore the importance of maintaining a balanced economic approach.

- While these principles drive efficiency and growth, over-reliance or lack of adaptability can introduce vulnerabilities.

- Recognising and mitigating these challenges allows for a more holistic and sustainable economic development strategy.

Exchange

The act of trading or swapping items of value is as old as human civilization itself. At its core, this act is what we refer to as ‘exchange.’ In the realm of economics, exchange plays a fundamental role in facilitating transactions, whether it’s bartering goods in a traditional marketplace or trading stocks in modern financial hubs.

The Basics of Exchange

Exchange involves two or more parties giving something of value to receive something else they deem as valuable. This mutual transfer can occur in various forms:

- Barter System: This is a direct trade of goods and services without the use of money. For instance, if you have apples and need oranges, you might find someone with oranges who needs apples and make a trade.

- Monetary System: In modern economies, most exchanges involve currency. You give money to receive goods or services, simplifying the process and removing the need for a double coincidence of wants, which is essential in a barter system.

Why Exchange Matters

- Fulfills Needs and Wants: Through exchange, individuals, businesses, and countries can acquire what they don’t produce, catering to their needs or desires.

- Encourages Specialisation: Knowing that they can exchange their specific products for other goods and services, producers are incentivized to specialize, leading to greater efficiency and productivity.

- Facilitates Price Determination: In markets, exchanges help set prices based on supply and demand dynamics.

- Promotes Interdependence: Countries trade with each other, importing what they don’t produce efficiently and exporting their specialties, fostering global interdependence.

- Boosts Economic Growth: Exchange, especially international trade, can significantly contribute to a country’s GDP and economic development.

Types of Exchange

- Bilateral Exchange: This involves two parties. For example, if you buy a book from a store, you’re part of a bilateral exchange.

- Multilateral Exchange: Involving more than two parties, this kind of exchange is common in complex markets. For instance, stock exchanges where multiple buyers and sellers interact fall under this category.

Limitations of Exchange

While exchange has its undeniable benefits, there are some limitations:

- Inequitable Distribution: Not everyone has equal access to markets, leading to disparities in wealth and opportunities.

- Over-reliance on External Markets: Too much dependence on foreign markets can make a country vulnerable to external economic shocks.

- Potential for Exploitative Practices: Without proper regulations, exchanges can lead to practices that might exploit workers, consumers, or the environment.

Key Information

- Exchange is the act of trading items of value, and it plays a foundational role in economics, fostering transactions, and promoting interdependence.

- It can take various forms, from traditional bartering to modern monetary systems.

- While exchange drives economic activity and growth, it’s essential to recognize and address its potential limitations and challenges.

Test Yourself

What is the primary purpose of resource allocation in economics?

The primary purpose of resource allocation in economics is to distribute the limited resources efficiently to meet the needs and wants of individuals and society.

Describe in your own words what a market is in the context of economics.

A market in the context of economics refers to a setup or system where buyers and sellers interact and engage in the exchange of goods, services, or resources, typically determining a price.

Differentiate between the factor and product markets.

Factor markets involve the trade of resources or inputs used in the production of goods and services, such as labor, capital, and land. Product markets, on the other hand, involve the trade of finished goods and services.

What does the term 'division of labour' refer to, and why is it beneficial for production?

Division of labour refers to the process where specific tasks within a larger job or production process are assigned to individual workers or entities. It’s beneficial because it leads to increased efficiency, as workers become specialized and more skilled at their designated tasks.

Name the three economic sectors and give a brief description of each.

Primary Sector: This sector involves the extraction of raw materials directly from the earth, such as agriculture, fishing, and mining.

Secondary Sector: Here, raw materials from the primary sector are processed and converted into finished goods. Examples include manufacturing and construction.

Tertiary Sector: This sector provides services instead of goods, such as banking, retail, and education.

How does the barter system differ from a monetary exchange system?

The barter system involves the direct exchange of goods and services without the use of money. In contrast, a monetary exchange system uses currency (money) as a medium to facilitate trade, eliminating the need for a double coincidence of wants that is required in bartering.

How can specialisation potentially lead to economic vulnerabilities for a country?

If a country specializes too heavily in one product or sector, it can become overly dependent on it. Any disruptions, such as falling global prices for that product or environmental issues affecting production, can have significant negative economic implications for the country.

What is the primary difference between a good and a service?

A good is a tangible item that can be physically touched and owned, such as a car or a book. A service, on the other hand, is an intangible act or function provided to consumers, like a haircut or legal advice.

How does exchange promote global interdependence among countries?

Exchange promotes global interdependence as countries often import what they don’t produce efficiently and export what they specialise in. This reliance on each other for goods and services fosters interconnectedness and cooperation among nations.

Mention a drawback of the division of labour for individual workers.

One drawback of the division of labour for individual workers is the potential for monotony and reduced job satisfaction. Continuously performing the same task can lead to boredom, reduced motivation, and even burnout.

Why might the allocation of resources in a centrally planned economy differ from that in a market-driven economy?

In a centrally planned economy, resource allocation decisions are made by the government or a central authority based on the economy’s broader goals, which might prioritize social welfare or strategic industries. In contrast, in a market-driven economy, resources are allocated based on supply and demand forces, emphasising individual preferences and profit maximisation.

In the context of factor markets, explain the relationship between labor and capital.

Labor refers to the human effort in production, while capital refers to man-made resources like machinery and equipment. The two often complement each other: increased capital can enhance labor productivity, while skilled labor can optimise capital utilisation. Their relative scarcity and productivity can influence wages and returns on capital.

How does the concept of diminishing returns relate to the division of labour?

The division of labour can lead to increased efficiency and output initially. However, after a certain point, adding more specialization or division might not yield proportionally higher outputs. This concept, akin to diminishing returns, suggests there’s an optimal point beyond which further division can be counterproductive.

If the tertiary sector grows disproportionately larger than the primary and secondary sectors in an economy, what potential challenges might arise?

A disproportionate growth of the tertiary sector might indicate over-reliance on services, potentially neglecting foundational industries like agriculture or manufacturing. This can lead to vulnerabilities like food and product imports dependency, loss of manufacturing skills, and potential unemployment in traditional sectors.

Explain how the concept of 'double coincidence of wants' limits the efficiency of the barter system.

In a barter system, for a trade to occur, both parties must want what the other is offering. This ‘double coincidence of wants’ makes exchanges cumbersome and inefficient, as finding such perfect matches is rare.

Describe a scenario where too much specialisation might be detrimental for a business in the long run.

If a tech company specializes exclusively in producing a specific model of a smartphone, and there’s a sudden shift in technology or consumer preference, the company might face significant losses. Over-specialisation can make it harder for the business to adapt to market changes.

How can market-driven resource allocation lead to public goods problems or externalities?

Market-driven resource allocation can sometimes neglect goods or services that are beneficial for society as a whole but aren’t profitable for individual providers (public goods). Additionally, markets might not account for external costs or benefits affecting third parties (externalities), like pollution from a factory affecting local residents.

Why might workers in the tertiary sector require different skill sets compared to those in the primary or secondary sectors?

The tertiary sector revolves around services. As such, workers often need interpersonal, communication, analytical, and problem-solving skills. In contrast, primary and secondary sectors might emphasise manual skills, technical know-how, or specific machinery operation skills.

How does the principle of comparative advantage relate to the concepts of specialisation and exchange?

The principle of comparative advantage suggests that entities (individuals, firms, countries) should specialize in producing goods/services where they have the lowest opportunity cost, even if they aren’t the absolute best at it. By doing so and engaging in exchange, overall productivity and efficiency in the system increase.

Why might a firm decide to diversify its products or services instead of continuing to specialise in a single area?

Diversification can reduce business risks associated with market changes, technological shifts, or competitive pressures. By offering a broader range of products or services, a firm can cater to varied consumer needs, hedge against potential downturns in specific segments, and tap into new revenue streams.